Identity theft is a significant and increasing concern in the digital era. It involves the unauthorized acquisition and use of personal information, typically for financial gain. This can encompass the theft of social security numbers, credit card details, or other confidential data.

The repercussions of identity theft can be severe, potentially resulting in financial losses, credit damage, and legal complications. There are several common methods employed by identity thieves. Phishing scams involve deceptive emails or websites that mimic legitimate entities to trick individuals into divulging personal information.

Data breaches occur when unauthorized parties gain access to a company’s database, potentially compromising the personal information of numerous individuals simultaneously. Physical theft of documents or cards, such as wallets, purses, or mail, can also provide criminals with access to personal data. Understanding these various forms of identity theft is essential for implementing effective protective measures.

The consequences of identity theft can be far-reaching, affecting an individual’s financial stability, credit rating, and legal standing. By being aware of these risks and the methods employed by identity thieves, individuals can take proactive steps to safeguard their personal information and reduce the likelihood of becoming victims of identity theft.

Key Takeaways

- Identity theft is a serious threat that can result in financial loss and damage to personal reputation.

- Strong security measures, such as using complex passwords and two-factor authentication, can help prevent identity theft.

- Artificial intelligence can be used to detect and prevent identity theft by analyzing patterns and anomalies in data.

- Cyberwar tactics, such as phishing and social engineering, can be recognized and avoided through education and awareness.

- Safeguarding personal information online, such as avoiding public Wi-Fi and being cautious with sharing personal details, is crucial in preventing identity theft.

- Regularly monitoring financial accounts and credit reports can help detect any suspicious activity and prevent further damage.

- Reporting suspected identity theft to the authorities and taking immediate action, such as freezing credit and closing compromised accounts, is essential in minimizing the impact of identity theft.

Implementing Strong Security Measures

In order to protect yourself from identity theft, it’s crucial to implement strong security measures both online and offline. This includes using complex and unique passwords for all of your accounts, as well as enabling two-factor authentication whenever possible. Strong passwords should include a combination of letters, numbers, and special characters, and should be different for each account to prevent a single breach from compromising all of your accounts.

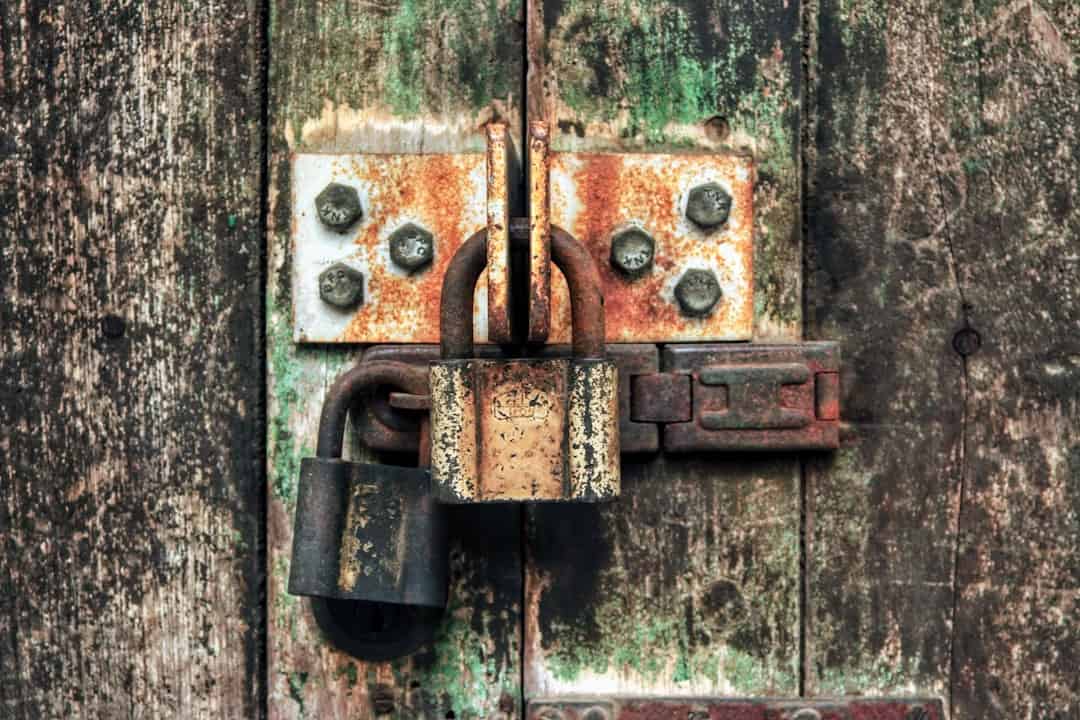

Two-factor authentication adds an extra layer of security by requiring a second form of verification, such as a code sent to your phone, in addition to your password. It’s also important to be cautious about the information you share online and to only provide personal information on secure websites. Look for “https” in the URL and a padlock symbol in the address bar to ensure that the website is secure.

Avoid sharing sensitive information on public Wi-Fi networks, as these are often unsecured and can be easily accessed by hackers. Additionally, be wary of phishing scams and never provide personal information in response to unsolicited emails or phone calls. Offline, it’s important to safeguard your physical documents and cards by keeping them in a secure location and shredding any sensitive documents before disposing of them.

Consider using a locking mailbox to prevent mail theft and regularly monitor your financial statements for any unauthorized activity. By implementing these strong security measures both online and offline, individuals can greatly reduce their risk of falling victim to identity theft.

Utilizing Artificial Intelligence for Detection and Prevention

Artificial intelligence (AI) has become an invaluable tool in the fight against identity theft. AI technology is able to analyze vast amounts of data at incredible speeds, making it an effective tool for detecting and preventing identity theft. AI can be used to monitor for suspicious activity on financial accounts, such as unusual spending patterns or transactions from unfamiliar locations.

It can also be used to identify potential phishing scams by analyzing the content of emails and websites for signs of fraud. In addition to detection, AI can also be used for prevention by implementing advanced security measures. For example, AI-powered systems can analyze user behavior to create a unique profile for each individual and detect any deviations from normal patterns that may indicate fraudulent activity.

This can help prevent unauthorized access to accounts and stop identity theft before it occurs. AI can also be used to enhance authentication processes by implementing biometric technology, such as fingerprint or facial recognition, which are much more difficult for thieves to replicate. Overall, AI technology has revolutionized the way in which identity theft is detected and prevented.

Its ability to analyze vast amounts of data at incredible speeds makes it an invaluable tool in the fight against identity theft. By utilizing AI for detection and prevention, individuals and organizations can greatly reduce their risk of falling victim to identity theft.

Recognizing and Avoiding Cyberwar Tactics

| Tactic | Description | Impact |

|---|---|---|

| Phishing | Deceptive emails or websites to steal sensitive information | Data theft, financial loss |

| Malware | Malicious software to disrupt or damage systems | Data loss, system damage |

| DDoS Attacks | Overwhelming a system with traffic to make it unavailable | Service disruption |

| Social Engineering | Manipulating individuals to gain access to sensitive information | Data theft, unauthorized access |

Cyberwar tactics are a growing concern in today’s digital landscape, as they can have serious implications for individuals and organizations alike. These tactics involve using cyber attacks to gain unauthorized access to sensitive information or disrupt critical infrastructure. It’s important to recognize these tactics in order to avoid falling victim to them and take the necessary precautions to protect against them.

One common cyberwar tactic is the use of malware, which is malicious software designed to gain unauthorized access to a computer system or network. Malware can be spread through phishing emails, infected websites, or removable storage devices, and can lead to identity theft or financial loss if not detected and removed promptly. Another tactic is the use of ransomware, which involves encrypting a victim’s files and demanding payment in exchange for the decryption key.

This can have devastating consequences for individuals and organizations if not properly addressed. In addition to malware and ransomware, cyberwar tactics also include distributed denial-of-service (DDoS) attacks, which involve overwhelming a target with a flood of internet traffic in order to disrupt their services. These attacks can lead to downtime for websites or online services, causing financial loss and reputational damage.

It’s crucial for individuals and organizations to recognize these cyberwar tactics in order to avoid falling victim to them and take the necessary precautions to protect against them.

Safeguarding Personal Information Online

Safeguarding personal information online is crucial in order to protect against identity theft and other cyber threats. This includes being cautious about the information you share on social media and other websites, as well as using secure methods for online transactions. Avoid sharing sensitive information such as your full name, address, phone number, or birthdate on public forums or social media profiles, as this information can be used by identity thieves to steal your identity.

When making online transactions, it’s important to use secure payment methods and only provide your credit card information on trusted websites. Look for “https” in the URL and a padlock symbol in the address bar to ensure that the website is secure before making a purchase. Avoid using public Wi-Fi networks for online transactions, as these are often unsecured and can be easily accessed by hackers.

It’s also important to regularly update your software and use antivirus programs to protect against malware and other cyber threats. Keep your operating system, web browser, and other software up to date with the latest security patches in order to prevent vulnerabilities from being exploited by hackers. By safeguarding your personal information online and taking the necessary precautions for online transactions, you can greatly reduce your risk of falling victim to identity theft.

Monitoring Financial Accounts and Credit Reports

Monitoring your financial accounts and credit reports is crucial in order to detect any unauthorized activity that may indicate identity theft. Regularly review your bank statements and credit card transactions for any unfamiliar charges or suspicious activity, as this could be a sign that someone has gained unauthorized access to your accounts. If you notice any discrepancies, report them to your financial institution immediately in order to prevent further financial loss.

In addition to monitoring your financial accounts, it’s important to regularly check your credit reports for any signs of identity theft. You are entitled to one free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every year, which you can request through annualcreditreport.com. Review your credit report for any unfamiliar accounts or inquiries that may indicate someone has stolen your identity.

If you suspect that you have fallen victim to identity theft based on your financial accounts or credit reports, it’s crucial to take immediate action in order to minimize the damage. Contact your financial institutions and credit bureaus to report the suspected identity theft and place fraud alerts on your accounts. You may also consider freezing your credit in order to prevent any new accounts from being opened in your name without your permission.

By monitoring your financial accounts and credit reports regularly and taking immediate action if you suspect identity theft, you can greatly reduce the impact of this devastating crime.

Reporting Suspected Identity Theft and Taking Action

If you suspect that you have fallen victim to identity theft, it’s crucial to report it immediately in order to minimize the damage and take the necessary steps to recover from it. Contact your financial institutions and credit card companies to report any unauthorized charges or suspicious activity on your accounts. They can help you dispute fraudulent charges and take steps to prevent further financial loss.

In addition to reporting suspected identity theft to your financial institutions, it’s important to contact the three major credit bureaus (Equifax, Experian, and TransUnion) in order to place fraud alerts on your credit reports. This will notify potential creditors that you may be a victim of identity theft and prompt them to take extra steps to verify your identity before opening new accounts in your name. You may also consider filing a report with the Federal Trade Commission (FTC) through their website at IdentityTheft.gov or by calling their toll-free number at 1-877-ID-THEFT (1-877-438-4338).

The FTC can provide you with a personalized recovery plan based on the information you provide about the suspected identity theft. Taking immediate action is crucial if you suspect that you have fallen victim to identity theft in order to minimize the damage and take the necessary steps to recover from it. By reporting suspected identity theft to your financial institutions, credit bureaus, and the FTC, you can greatly reduce the impact of this devastating crime on your finances and personal well-being.

In conclusion, understanding the threat of identity theft is crucial in order to protect yourself from falling victim to it. By implementing strong security measures both online and offline, utilizing artificial intelligence for detection and prevention, recognizing and avoiding cyberwar tactics, safeguarding personal information online, monitoring financial accounts and credit reports, reporting suspected identity theft, and taking immediate action if it occurs, individuals can greatly reduce their risk of becoming victims of this devastating crime. It’s important for everyone to take these precautions seriously in order to protect themselves from the serious consequences of identity theft.

Identity theft is a growing concern in the digital age, with more and more people falling victim to cybercriminals who steal their personal information for fraudulent purposes. In a related article on challenges and opportunities in the metaverse: business and economic perspectives, the potential risks of identity theft in virtual worlds are explored, highlighting the need for ethical considerations and robust security measures to protect users from exploitation. As the metaverse continues to evolve, it is crucial for businesses and individuals to be aware of the potential threats and take proactive steps to safeguard their identities.

FAQs

What is identity theft?

Identity theft is a crime in which someone wrongfully obtains and uses another person’s personal data in a fraudulent or deceptive manner, typically for economic gain.

What are the common methods used in identity theft?

Common methods used in identity theft include phishing emails, data breaches, social engineering, and stealing physical documents such as credit cards or identification.

What are the potential consequences of identity theft?

The potential consequences of identity theft can include financial loss, damage to credit score, legal issues, and emotional distress. It can also take a significant amount of time and effort to resolve the issues caused by identity theft.

How can I protect myself from identity theft?

To protect yourself from identity theft, you can take steps such as regularly monitoring your financial accounts, using strong and unique passwords, being cautious about sharing personal information online, and shredding sensitive documents before disposing of them.

What should I do if I suspect I am a victim of identity theft?

If you suspect you are a victim of identity theft, you should immediately contact your financial institutions, credit bureaus, and law enforcement. It is important to report the incident and take steps to mitigate any potential damage to your identity and finances.

Leave a Reply